Finbro PH Loan: Reviews App Online Philippines (2026)

Finbro PH has emerged as a prominent online lending platform in the Philippines. This comprehensive review aims to provide an in-depth analysis of Finbro PH, including its legitimacy, the application process for fast loans, loan limits, interest rates, and payment methods. By delving into these aspects, individuals seeking financial solutions can make informed decisions when considering Finbro PH as their preferred lending option.

Summary of Finbro PH

Review: Finbro Loan

Finbro PH offers a convenient and efficient lending service to its customers. With a range of loan options, it caters to diverse financial needs. This review delves into the essential aspects of Finbro loans, enabling individuals to assess its suitability for their specific requirements.

Guide to Applying for a Loan with Finbro Philippines

The application process for a loan with Finbro PH is user-friendly and accessible. This section provides a step-by-step guide to help individuals navigate through the loan application process smoothly.

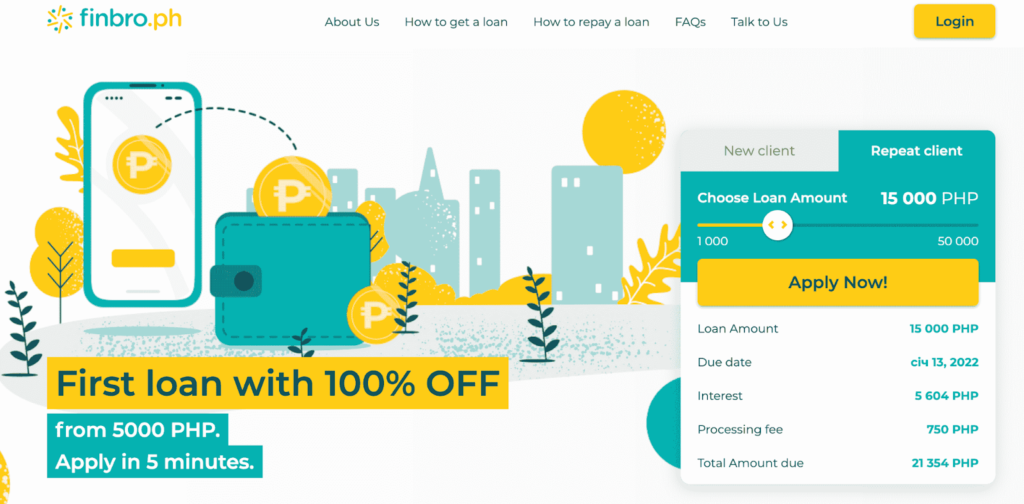

Loan Amount: 1000 – 50,000 PHP

Finbro PH offers loan amounts ranging from 1000 to 50,000 PHP, providing borrowers with flexibility to meet their financial obligations effectively.

Age Requirement: 20 – 65 years old

To be eligible for a loan with Finbro PH, individuals must fall within the age range of 20 to 65 years old.

Loan Term: 1 – 12 months

Finbro PH allows borrowers to choose a loan term that suits their needs, ranging from a minimum of 1 month to a maximum of 12 months.

Interest Rate: 0.5 – 1.25% per day

The interest rates offered by Finbro PH range from 0.5% to 1.25% per day, depending on various factors such as the borrower’s credit history and profile.

Pros: Acceptable Harassment

One of the advantages of Finbro PH is its willingness to accommodate borrowers who have experienced financial harassment in the past.

Cons: Service Fee Applicable

While Finbro PH provides convenient loan options, borrowers should be aware that there is a service fee associated with the loan.

Evaluation of Effectiveness: Good

Based on user feedback and overall performance, Finbro PH is considered effective in meeting the financial needs of its customers.

Bad Debt: Allow

Finbro PH extends its services to individuals with bad debt, providing them with an opportunity to rebuild their financial standing.

Feedback: Read More in This Post

To gain deeper insights into customer experiences and feedback regarding Finbro PH, readers are encouraged to explore the post further.

What is Finbro?

Overview

Finbro is an online lending service operating in the Philippines. It aims to address the financial requirements of individuals by providing fast and reliable solutions. The platform operates 24/7 and can be accessed through mobile phones or personal computers.

Loan Limit and Term

Finbro PH offers loan limits ranging from 1000 to 50,000 PHP, allowing borrowers to obtain the desired amount based on their needs. The loan term ranges from 1 to 12 months, providing borrowers with flexibility in repaying their loans.

Pros of Finbro PH

Accessibility

Finbro PH enables borrowers to apply for loans conveniently from any mobile device or computer, making it accessible and user-friendly.

Simple Registration Process

The registration process for Finbro PH is streamlined and straightforward. Borrowers only need to provide one valid ID, reducing the hassle of extensive paperwork.

No Financial Proof, Collateral, or Guarantor Required

Unlike traditional banks or financial institutions, Finbro PH does not require borrowers to submit financial proof or provide collateral or a guarantor. This feature makes it more accessible to a broader range of individuals.

Quick Approval and Disbursement

Finbro PH boasts a fast approval process, with loan applications typically processed within 15 minutes. Once approved, the loan amount is swiftly disbursed to the borrower’s bank account or e-wallet.

0% Interest Rate and No Service Fee for First-Time Borrowers

First-time borrowers enjoy the benefit of 0% interest rates and no service fees, making Finbro PH an attractive option for those seeking their initial loan.

Confidentiality of Personal Information

Finbro PH prioritizes the confidentiality of borrowers’ personal information. Robust security measures are implemented to safeguard sensitive data.

Acceptable Harassment

Finbro PH is known for its willingness to assist individuals who have experienced financial harassment in the past, providing them with a supportive lending environment.

Cons of Finbro App

Additional Processing Fee

While Finbro PH offers convenient loan options, borrowers should take note of the additional processing fee associated with the loan.

Limited Loan Amount

Finbro PH sets a maximum loan limit, which may not meet the financial requirements of individuals seeking larger sums for business ventures, property purchases, or vehicle acquisitions.

Higher Interest Rates

Compared to loans obtained from traditional banks or financial institutions, Finbro PH’s interest rates tend to be higher. Borrowers should carefully consider the cost implications before opting for a loan.

No Support for Bad Debt Customers

Finbro PH does not cater specifically to customers with bad debt, which may limit options for individuals seeking financial assistance in such circumstances.

Finbro Loan Interest Rate

Finbro PH offers online loan interest rates ranging from 0.5% to 1.25% per month. The specific interest rate assigned to a borrower is determined based on their credit history and profile.

Example of Finbro Interest Rate Calculation

Illustrative Scenario

To provide clarity on interest rate calculations, let’s consider an example. Suppose a customer borrows 10,000 pesos for a duration of 30 days, with an interest rate of 1% per day.

Calculation

The total interest payable after 30 days would amount to 10,000 x 1% x 30 days = 3,000 pesos. Additionally, a service fee of 10,000 x 9% = 900 pesos would apply. Consequently, the total amount payable after 30 days would be 10,000 + 3,000 + 900 = 13,900 pesos.

Finbro Loan Requirements

Eligibility Criteria

To qualify for a loan with Finbro PH, borrowers must be Filipino citizens aged between 20 and 65 years old. Additionally, they must possess at least one valid ID. Additional documents such as payroll, Certificate of Employment (COE), Income Tax Return (ITR), company ID, or DTI may be requested.

First Loan Application

First-time borrowers are only required to complete the registration form on Finbro PH’s homepage and submit a two-sided ID card photo for verification purposes.

Subsequent Loan Applications

After successfully securing their first loan and maintaining a reputable payment record, borrowers can apply for subsequent loans by simply logging into their registered accounts and selecting the desired loan limit. Finbro PH processes loan applications promptly for returning customers.

Guide to Finbro Loan Application Step-by-Step

- Step #1: Choose Desired Loan Amount and Term Using the Finbro PH app or website, borrowers can select their preferred loan amount and repayment term based on their financial needs.

- Step #2: Provide Required Information Borrowers must input accurate personal information, including their full name, contact details, employment status, monthly income, and other relevant details as requested by Finbro PH.

- Step #3: Submit Required Documents First-time borrowers need to submit a scanned or photographed copy of their two-sided valid ID card for verification. Additional documentation may be requested depending on the borrower’s profile.

- Step #4: Wait for Loan Approval After submitting the application and required documents, borrowers need to wait for the loan approval process, which typically takes around 15 minutes.

- Step #5: Receive Loan Disbursement Once the loan is approved, the loan amount is disbursed directly to the borrower’s nominated bank account or e-wallet within a short period.

Finbro Payment Options

Automatic Debit Arrangement (ADA)

Finbro PH offers an ADA option, enabling borrowers to automate their loan repayments. The installment amount is automatically deducted from the borrower’s bank account on the scheduled due date.

Over-the-Counter (OTC)

Payment Borrowers can also make payments over the counter at partner payment centers, allowing for flexibility and convenience in settling loan repayments.

Mobile Banking and Online Transfer

Finbro PH accepts payments through various mobile banking applications and online transfer platforms. Borrowers can conveniently make their payments using these digital payment options.

Conclusion

Finbro PH stands as a reliable online lending platform that caters to the financial needs of Filipinos. With its user-friendly application process, accessible loan limits, and quick disbursement, Finbro PH has gained popularity among borrowers seeking fast and convenient loan options. However, borrowers should carefully consider the interest rates and associated fees before committing to a loan. By conducting due diligence and assessing personal financial circumstances, individuals can determine whether Finbro PH is the right choice for their borrowing needs.