When it comes to financial emergencies, having access to instant loans can be a real lifesaver. In the Philippines, CashExpress loan apps have become increasingly popular for their quick and convenient loan services. Whether you need extra cash for medical expenses, home repairs, or any other urgent financial needs, CashExpress loan apps can provide you with the funds you need in no time.

Top 10 Fast Online Loans in Philippines – A Valid ID is All You Need Updated in December 2024

| Rank | Lender Name & Application Link | Loan Amount | Loan Term | Interest Rate | Repayment | ID Required | Age Range | Special Feature |

|---|---|---|---|---|---|---|---|---|

| #1 |

SOSCREDIT |

₱1,000 – ₱25,000 | 3 – 12 months | 0% for first loan | Monthly or End of term | Only ID Card required | 20 – 70 | Receive money in 15 mins |

| #2 |

CREDIFY |

₱1,000 – ₱25,000 | 3 – 12 months | 0% for first loan | Monthly or End of term | Only National ID required | 20 – 70 | Receive money in 15 mins |

| #3 |

CREZU |

₱1,000 – ₱25,000 | 2 – 4 months | 0% for first loan | Monthly or End of term | Only ID Card required | 18 – 70 | Easy loan approval |

| #4 |

FINBRO |

₱1,000 – ₱50,000 | 1 – 12 months | 0% for first loan | Monthly or End of term | Only ID Card required | 20 – 65 | Receive money in 10 mins |

| #5 | CREDITIFY Apply Now |

₱1,000 – ₱25,000 | 1 – 180 days | 0.1% | Monthly or End of term | Only ID Card required | All accepted | Approve Bad credit |

| #6 | CASHSPACE Apply Now |

₱1,000 – ₱25,000 | 2 – 4 months | 0% for first loan | Monthly or End of term | Only ID Card required | 18 – 70 | Easy loan approval |

| #7 | DIGIDO Apply Now |

₱1,000 – ₱25,000 | 3 – 6 months | 0% for 7 days | Monthly or End of term | Only ID Card required | 21 – 70 | Receive money in 4 mins |

| #8 | KVIKU Apply Now |

₱500 – ₱25,000 | 60 – 180 days | 1.2% per month | Monthly or End of term | Only ID Card required | 18 – 65 | Receive money in 5 mins |

| #9 | CASHEXPRESS Apply Now |

₱1,000 – ₱20,000 | 7 – 30 days | 0% for first loan | End of term | Only ID Card required | 21 – 70 | Receive money in 5 mins |

| #10 | MONEYCAT Apply Now |

₱500 – ₱20,000 | 7 – 180 days | 0% for first loan | End of term | Only ID Card required | 22 – 65 | Easy loan approval |

What are CashExpress Loan Apps?

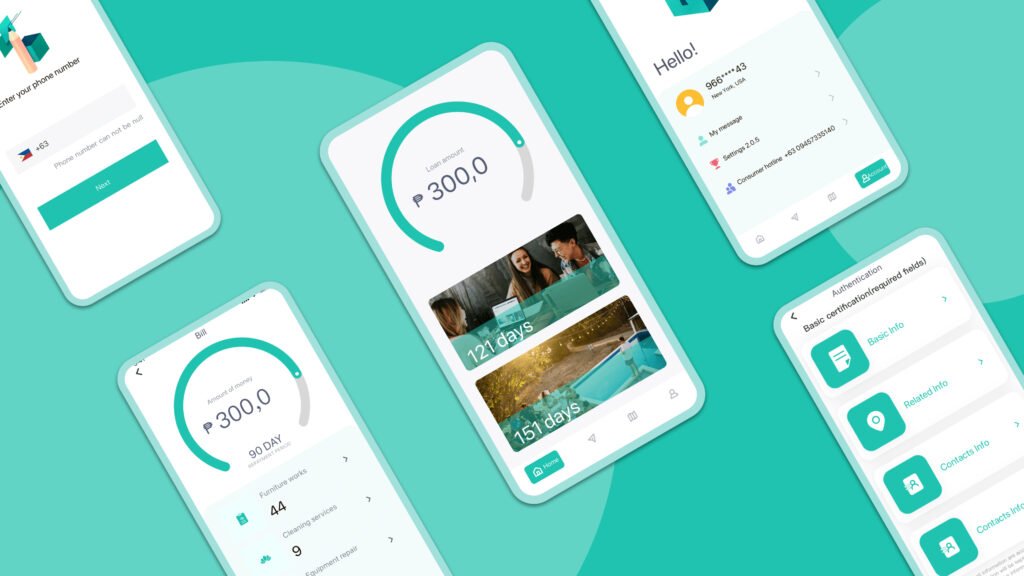

CashExpress loan apps are mobile applications that allow users to apply for instant loans directly from their smartphones. These apps have simplified the loan application process, making it faster and more accessible for Filipinos in need of immediate financial assistance. With CashExpress loan apps, you can apply for a loan anytime and anywhere, without the need for lengthy paperwork or visits to a physical branch.

How Do CashExpress Loan Apps Work?

The process of getting an instant loan through CashExpress loan apps is simple and straightforward. Here’s how it works:

- Download the App: Start by downloading the CashExpress loan apps from the Google Play Store or Apple App Store. The app is free to download and compatible with most smartphones.

- Create an Account: Once you have the app installed, create an account by providing your personal information, such as your name, contact details, and identification documents.

- Submit a Loan Application: After creating an account, you can now submit a loan application. Specify the loan amount you need and choose the repayment term that suits your financial situation.

- Upload Required Documents: CashExpress loan apps may require you to upload certain documents to verify your identity and income. These documents may include a valid ID, proof of address, and proof of income.

- Wait for Approval: Once you have submitted your application and documents, you will need to wait for the loan approval. CashExpress loan apps typically provide a quick response, with some applications being approved within minutes.

- Receive the Funds: If your loan application is approved, the funds will be disbursed directly to your bank account or mobile wallet. You can then use the money for your financial needs.

- Repay the Loan: Repayment terms will vary depending on the loan amount and chosen repayment term. CashExpress loan apps usually offer flexible repayment options, allowing you to repay the loan in installments.

Benefits of Using CashExpress Loan Apps

There are several benefits to using CashExpress loan apps for instant loans in the Philippines:

- Speed and Convenience: CashExpress loan apps provide a quick and convenient way to apply for a loan. You can complete the entire process from your smartphone, saving you time and effort.

- Accessibility: With CashExpress loan apps, you can apply for a loan anytime and anywhere, as long as you have an internet connection. This accessibility makes it easier for individuals in remote areas to access financial assistance.

- Minimal Requirements: Compared to traditional loan applications, CashExpress loan apps have minimal requirements. You typically only need to provide basic personal information and a few supporting documents.

- Fast Approval: CashExpress loan apps are known for their fast approval process. In many cases, you can receive a loan approval within minutes of submitting your application.

- Flexible Repayment Options: CashExpress loan apps offer flexible repayment options, allowing you to choose a repayment term that fits your financial situation. This flexibility helps ensure that you can repay the loan without straining your budget.

Top CashExpress Online Loan Apps in the Philippines

Numerous companies in the Philippines provide expedited online loan services, enabling you to secure a loan from the comfort of your own home. The application process is streamlined and hassle-free, typically necessitating only a single valid ID and a bank account.

Listed below are some of the leading loan apps in the Philippines:

- Cash-express – Offering short-term credit solutions with competitive interest rates and loan amounts of up to ₱20,000!

- Gcash – A mobile wallet application enabling users to swiftly access cash credits and settle bills conveniently via their smartphones.

- PayMaya – With PayMaya, users can effortlessly apply for swift financial assistance and receive funds within as little as one business day.

- Digido – Providing users instant cash access sans collateral or obscured charges.

- Home Credit – Specializing in gadget and appliance financing, this app simplifies the process of acquiring essential items promptly.

These lenders represent only a fraction of the diverse options available in the Philippines. With such a plethora of choices, finding the ideal fit for your requirements is easily achievable!

Conclusion

Instant loans with CashExpress loan apps have revolutionized the way Filipinos access financial assistance. These apps provide a convenient and efficient way to apply for a loan, with quick approval and flexible repayment options. Whether you have an unexpected medical expense or need to cover urgent home repairs, CashExpress loan apps can help you get the funds you need in no time.